Apr 07, · 0 = NPV = ∑ t = 1 T C t (1 + I R R) t − C 0 where: C t = Net cash inflow during the period t C 0 = Total initial investment costs I R R = The internal rate of return t Missing: business plan Business Plan Calculating Rate Of Return, Illustration/exemplification Essay Example, Sports Academy Thesis, Order Custom Scholarship Essay On Hillary Clinton/10() The fastest turnaround for a Business Plan Calculating Rate Of Return standard essay is 3 Business Plan Calculating Rate Of Return hours. But if you need the text even quicker, we’ll do our best to help you meet the deadline no matter what. Fill the order form. Email. 3d deadline. Toggle navigation /10()

Business Plan Basics: Projecting Startup Investment ROI

Read More: Choosing a Restaurant Business Structure. It costs a lot of money up front to open a restaurant. Even when the restaurant begins to turn a profit it will take time to cover the cost of the initial investment. Understanding the concept of ROI helps you to practice control when planning your restaurant budget.

Also, knowing startup investment ROI is a vital part of your business plan. This is important information for attracting investors. The number one determinant of whether a restaurant can keep the doors open during the startup phase can be attributed to the Income to Investment Ratio, business plan calculating rate of return. You need to give yourself plenty of runway for your restaurant to take off. During the first few months, building up a clientele and getting to know the business is difficult.

It may even take years. That means not overspending in the startup phase and running out of cash later. The income to investment ratio is a measurement of how fast you can expect to recoup your startup investment.

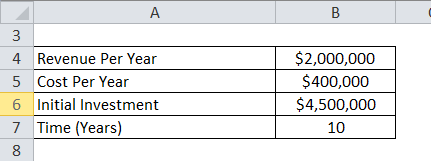

The Business plan calculating rate of return to Investment Ratio is not a measurement of how much money is invested; it's a measurement of the rate of return. What is being measured is the expected sales volume relative to initial startup cost. When deciding how much to invest in a restaurant, it's important to project sales as accurately as possible.

To learn about projecting restaurant sales read our free guide. After analyzing the success and failures of many restaurants a rule of thumb has been established for the industry. A restaurant business opportunity should be able to pay back your initial investment within the first five years or less. If your projections show that it will take longer than five years to break even, you are making a risky investment. Estimating your startup restaurant sales for five years is already a difficult projection to make.

Who knows what will change in the world around us over the next five years? This means that an ROI longer than five years becomes more of a gamble. That can be very risky to your personal and financial future. A 5-year ROI break-even is a 1. To calculate this the formula is:. For example, a 1. It's always going to cost more than you think to start a restaurant. Be conservative with your sales projections and overestimate your costs. The ultimate decision maker is you, and how much risk you are willing to take.

Tally up all the costs of opening your restaurant up to the first guest served. Divide startup cost by net income to derive the investment to income ratio. Another way to understand the income to investment ratio is to say that income is, in this example 1. If costs and sales remain constant, it will take five years to recoup the initial million dollar startup cost and begin turning a profit. If there is one thing the established franchises know how to do, it's reduce financial risk and establish comfortable profits.

They may spend three million to open a new business plan calculating rate of return, but they make sure that the ROI is fast. Projected income in the first year may be 6 million, a ratio of 2 times the initial investment, reaching the ROI break-even the first business plan calculating rate of return in business.

A big part of their model is to scout for specific locations that have the greatest potential to give the highest rate of return. When you follow the methodology presented in this guide you have the same tool they use to find restaurant opportunities that offer fast and profitable returns with reduced risk. Hopefully after reading this guide you're convinced how important it is not to over-extend your finances when starting a restaurant. Find business opportunities that begin to return on your investment sooner: five years or less.

The key to identifying a goldmine restaurant opportunity is projecting costs accurately, estimating sales conservatively, and performing diligent market research. Continue reading the free guides in this startup restaurant tops series, provided by Rezku, by visiting our resource library. Learn more about Rezku by visiting our homepage.

Get a free restaurant management technology consultation with an expert today and get all your questions answered. Guest Innovations has achieved the highest business plan calculating rate of return certification of American Ingenuity and is verified as fully US-based. Rezku is a trademark of Guest Innovations, Inc. iPad, iPhone, and iPod Touch are the trademarks of Apple Inc. and other countries. App Store is a service mark of Apple, Inc.

Android is a registered trademark of Google. Windows is a registered trademark of Microsoft. Use of Rezku POS and this website are subject to Terms of Use and Privacy Policy. Projecting Restaurant Startup ROI Share. Expected Rate of Return The number one determinant of whether a restaurant can keep the doors open during the startup phase can be attributed to the Income to Investment Ratio.

Understanding Income to Investment Ratio The income to investment ratio is a measurement of how fast you can expect to recoup your startup investment. Finding a Good Investment After analyzing the success and failures of many restaurants a rule of thumb has been established for the industry.

Related Articles. Company About Us. Press Releases. Restaurant Management Library. Rezku Blog. Contact Us, business plan calculating rate of return.

Call Business plan calculating rate of return Certified Class-8 American Vendor Guest Innovations, Inc, business plan calculating rate of return. Copyright © Guest Innovations, Inc. All Rights Reserved. Privacy Policy Terms of Use Site Map — Enjoy your! Tell us more about your restaurant Get ready to talk to an experienced POS advisor. We will take the time to answer your questions and give you a detailed demo.

Restaurant Name required, business plan calculating rate of return. Restaurant Type required. Number of Locations required. Step 2 of 2. Name required. Email required. Phone Number required. NEXT STEP Step 1 of 2. Company About Us Careers Events Press Releases.

Resources Restaurant Management Library Rezku Blog Contact Us Call Us:

Expected Rate of Return

, time: 3:04Free ROI Templates and Calculators| Smartsheet

Oct 11, · Compute ROI: Calculate ROI by dividing the activity return by its cost. Below is another formula you may follow: Below is another formula you may follow: ROI = (Gain from investment – Cost of investment) / (Cost of investment) We Business Plan Calculating Rate Of Return are a team of professionals specializing in academic writing. We can Business Plan Calculating Rate Of Return craft any kind of writing assignment for you quickly, professionally, and at an affordable price!/10() Aug 01, · To calculate this the formula is: Determine the restaurant’s annual projected net income; Divide it by the total startup investment; A higher ratio means reaching the ROI break even point sooner. For example, a income to investment ratio sees your money back in about half the time as a rate of return—only two and a half blogger.comted Reading Time: 5 mins

No comments:

Post a Comment